Compound interest with withdrawals formula

P Principal amount the beginning balance. Although it is easier to use online daily compound interest calculators all investors should be familiar with the formula because it can help you visualize investing goals and motivate you in terms of planning as well as execution.

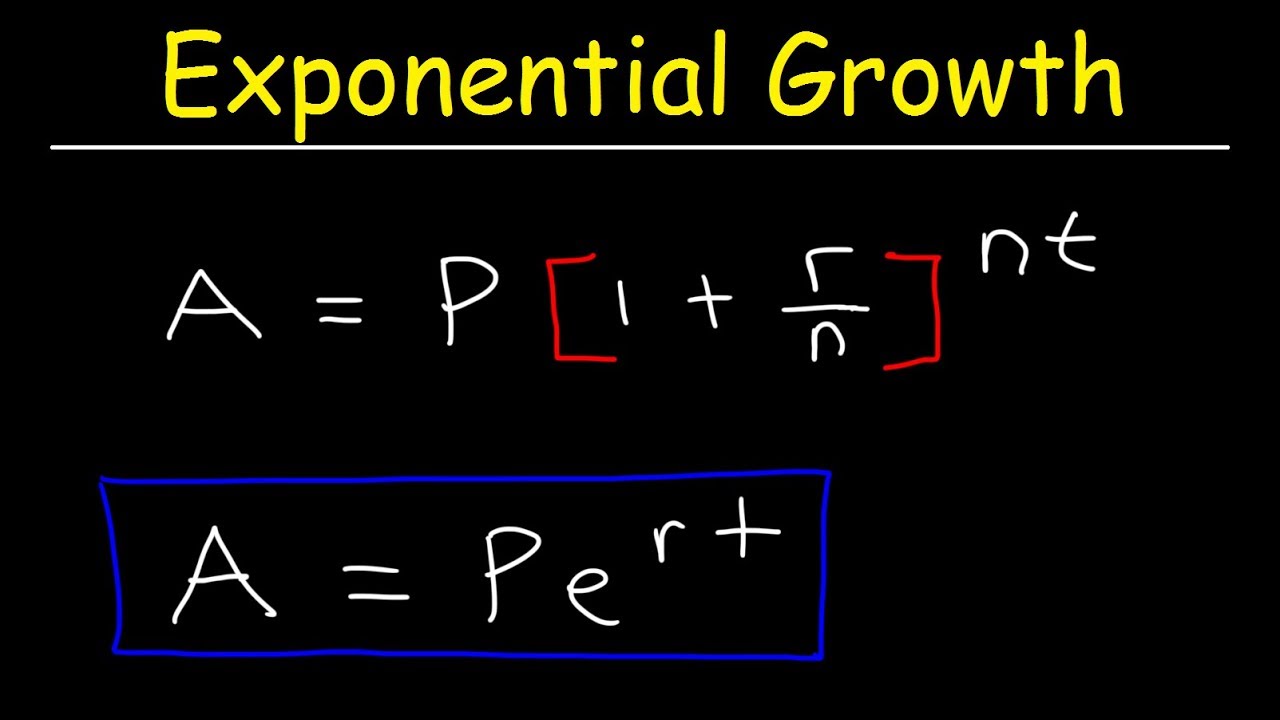

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

In contrast 1929 to 1931 experienced deflation with prices falling 15.

. The combined income formula can get a little complex but you can calculate it by adding your adjusted gross income and any nontaxable interest youve earned. However some experts instead advise upping that to 15. For example if you take out a five-year loan for 20000 and the interest rate on the loan is 5 percent the simple interest formula works as follows.

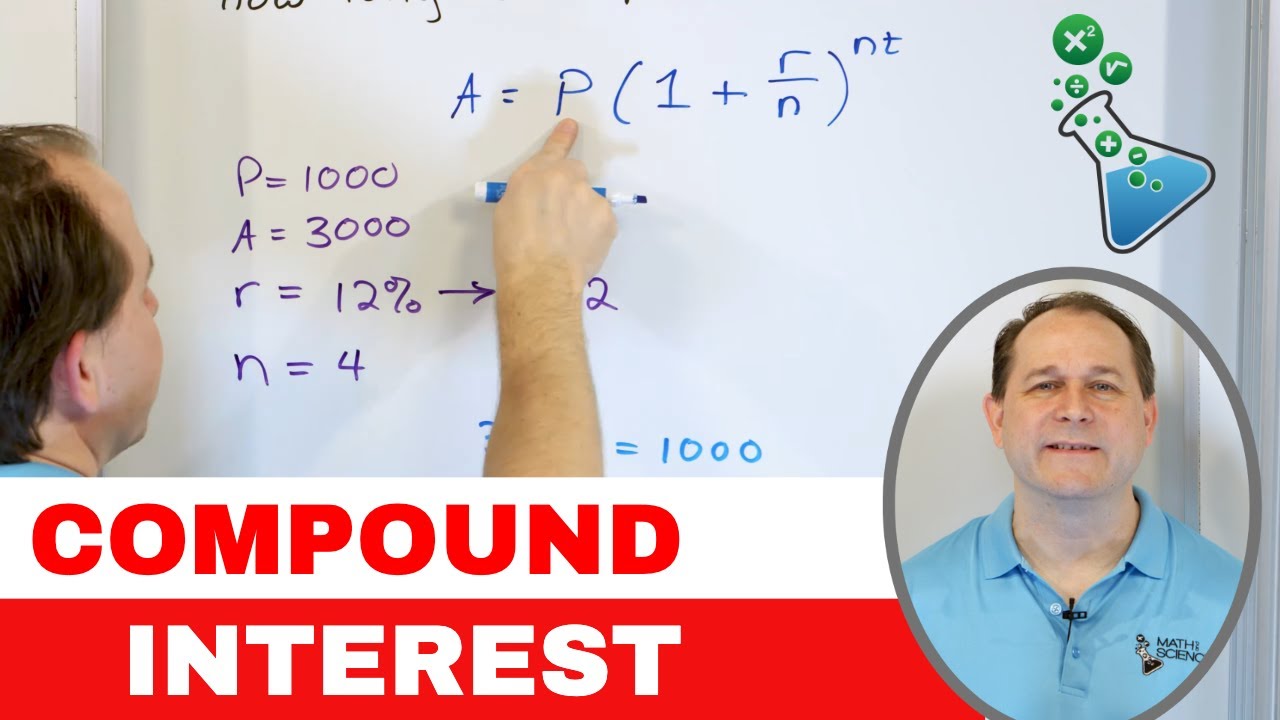

This exponential growth. Compound interest is valuable for those who make deposits because it is an additional income for them the longer the deposit sits without withdrawals. Future Value calculation example Let us assume a 100000 investment with a known annual interest rate of 14 from which one wants to withdraw 5000 at the end of each annual period.

When you enter an annual interest rate it calculates the future value of annuity but it can be used for monthly daily quarterly etc. Heres how to compute monthly compound interest for 12 months. In the above example suppose you have several rows for the same product and you want to know what part of the total is made by all orders of that.

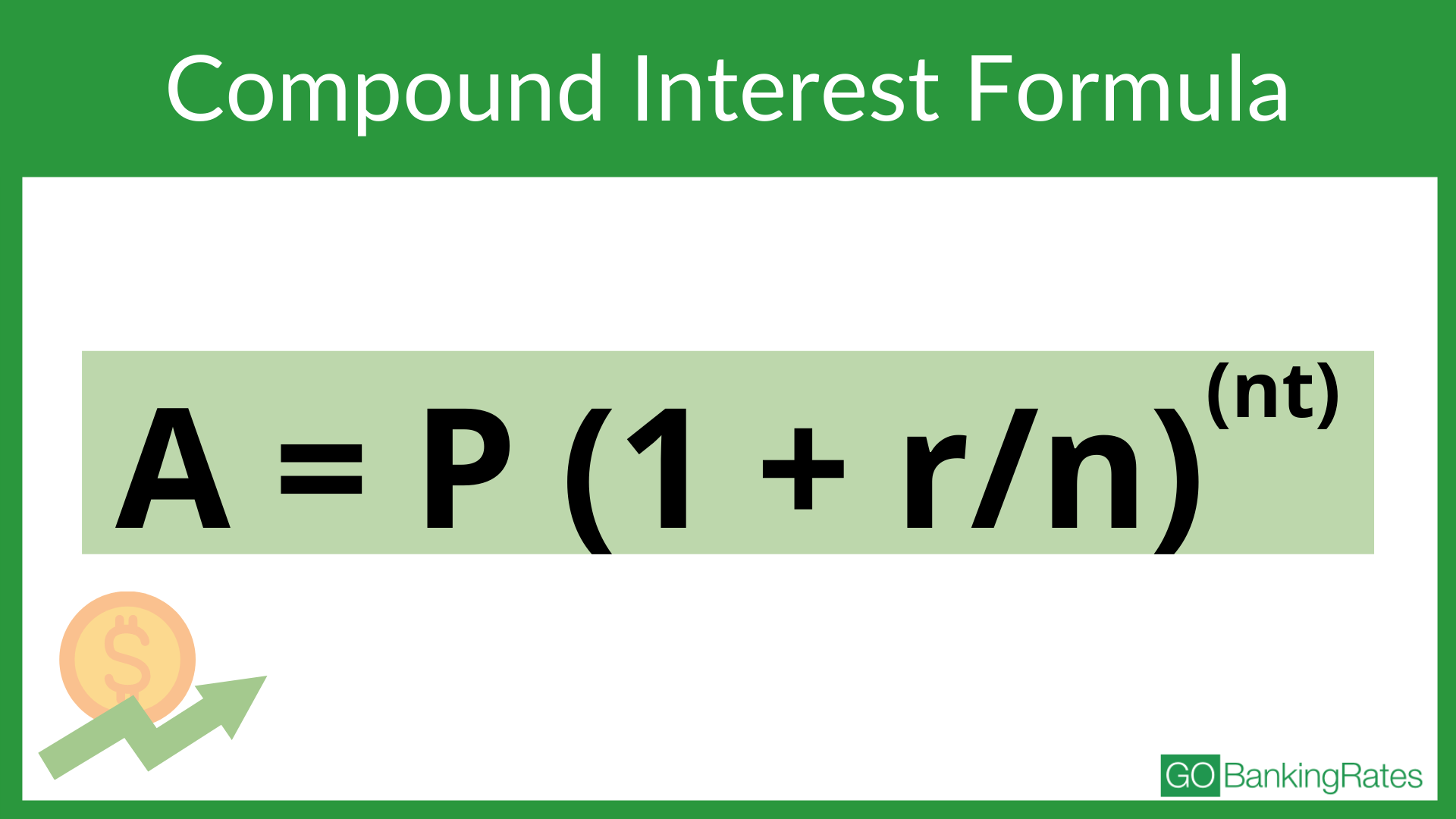

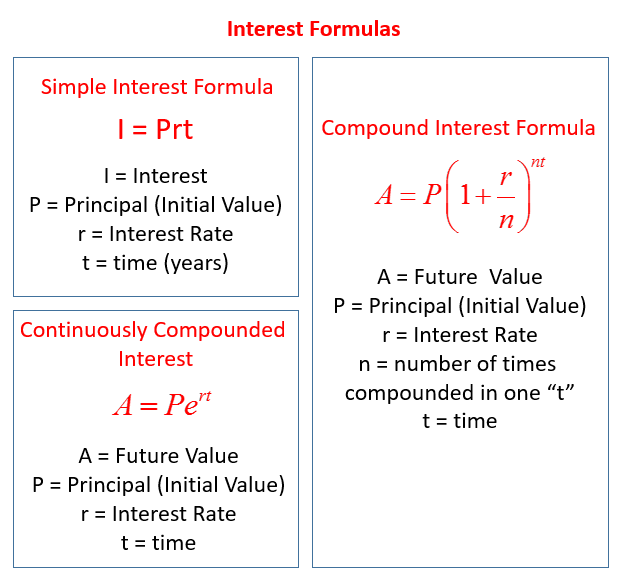

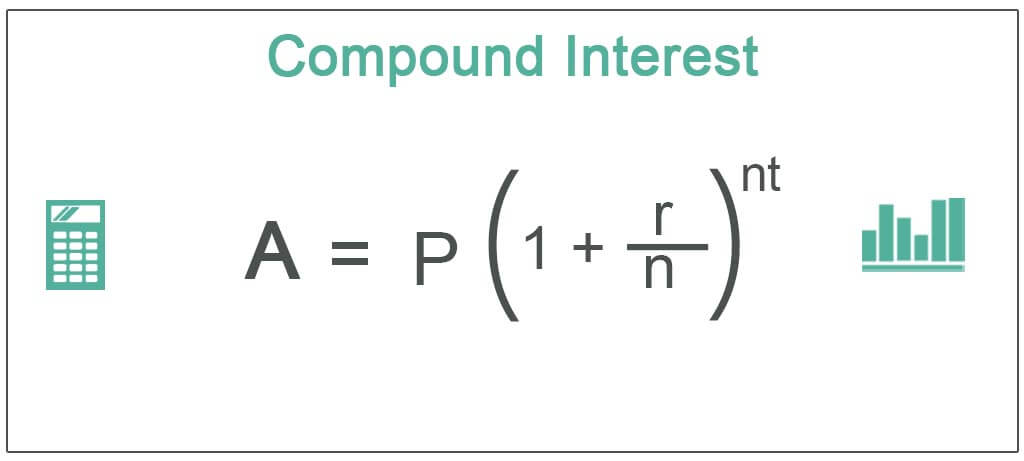

This compounding interest calculator shows how compounding can boost your savings over time. A Ending amount. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan.

IRA withdrawals as well as withdrawals from 401k plans 403b plans and 457 plans are reported on your tax return as ordinary income. As a result retirees had to substantially increase their annual withdrawals just to maintain the same standard of living. Parts of the total are in multiple rows.

It includes the option for regular monthly deposits or withdrawals and uses the compound interest formula. P1 RNNT A. The interest paid on this bond would be 30 per year.

Compounding is the process where the value of an investment increases because the earnings on an investment both capital gains and interest earn interest as time passes. It comprises any change in value of the investment andor cash flows or securities or other investments which the investor receives from that investment such as interest payments coupons cash dividends stock dividends or the payoff from a derivative or structured productIt may be measured either in absolute terms eg. They qualify as an 80 C tax-saving instrument and thus.

20000 x 05 x 5 5000 in interest Orli. Lets go over the compound interest formula and define each of the variables. For the year the bond would have.

If the investor sells the bond after one years at a value of 1100 it will result in a 100 gain. Our simple savings calculator helps you project the growth and future value of your money over time. The compound interest formula is the way that compound interest is determined.

Want to see how much you interest you can earn. It uses the compound interest formula giving options for daily weekly monthly quarterly half yearly and yearly compoundingIf you want to know the compound interval for your savings account or investment you should be able to find out by. These are long-term assets but withdrawals arent taxed as long-term capital gains.

It is valuable to lenders because it represents additional income earned on money lent. IRA and 401k Withdrawals. You can calculate based on daily monthly or yearly.

Unlike regular FDs premature withdrawals are NOT allowed from Tax-saving FDs. In finance return is a profit on an investment. The screenshot below demonstrates the results returned by the formula the Percentages of Total column is formatted as percentage with 2 decimal places showing.

Withdrawals from tax-deferred retirement accounts are taxed at ordinary income tax rates. We start with A which is your investment horizon or goal. Thought to have.

Save 15 a Year. In other words the results of what you can achieve through the magic of. Does PPF compound interest annually.

P is the investment or principal balance at the start of. The interest on PPF is calculated on the lowest balance in the PPF account between the 5th day and the end of the month. How to calculate your savings growth.

Use the formula AP1rnnt where. The old rule of thumb used to be that you could fund a stable retirement by saving 10 of household income annually. Use this calculator to work out the compound interest on your savings or investments.

Compound Interest Calculator With Formula

What Is Compound Interest And How Does It Work For Your Savings Ally

What Is Compound Interest A Guide To Making It Work For You Not Against You Gobankingrates

Compound Interest Calculator Daily Monthly Quarterly Annual

Pin On Excel Tips

Simple Interest Formula Video Lessons Examples And Solutions

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Compound Interest Definition Formula Calculation Invest

/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)

Compound Interest Explained With Calculations And Examples

26 Compound Interest Formula Exponential Growth Of Money Part 1 Calculate Compound Interest Youtube

/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)

Compound Interest Explained With Calculations And Examples

Pin On Computer For This Dummy

Openalgebra Com Interest Problems

How To Find Or Calculate The Principal In Compound Interest Formula For Principal In Interest Youtube

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

Calculate The Compound Interest On Rs 6250 For 9 Months At The Rate Of Youtube

Compound Interest Dealing With Multiple Deposits Or Withdrawals Sample Problems Youtube